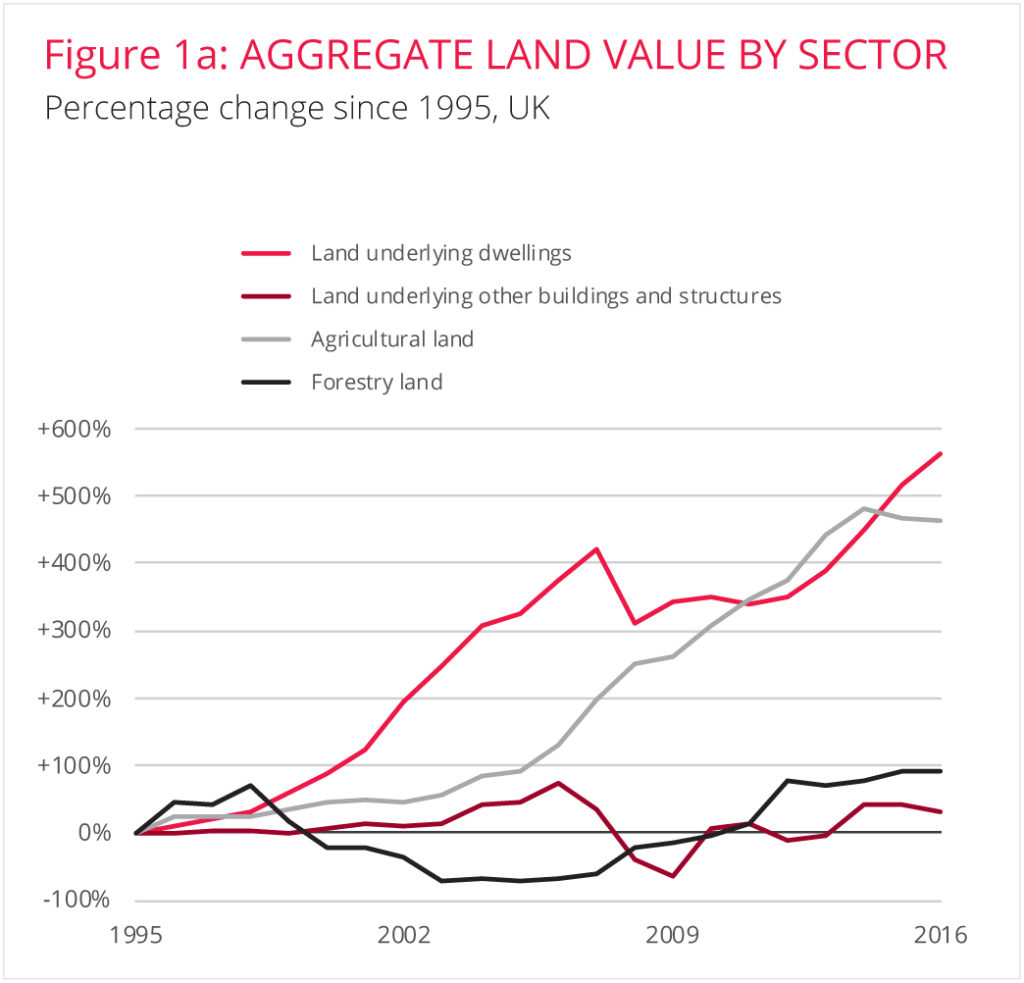

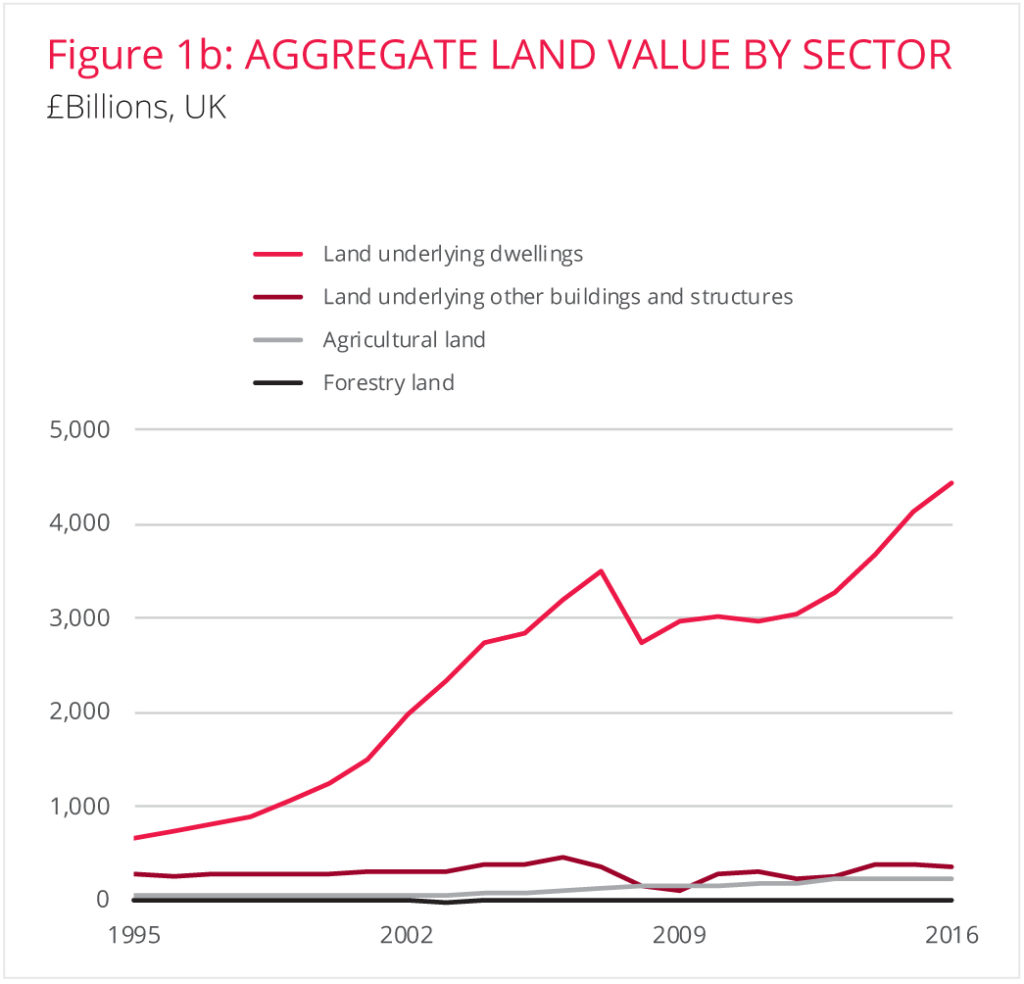

In 2017 the Office for National Statistics published, for the first time, estimates for the aggregate value of the land in the UK.[1] The data reveals that in just two decades the market value of land has quadrupled, increasing recorded wealth by over £4 trillion. Agricultural land and residential land have experienced the most dramatic price increases (figures 1a and 1b).

Source: Office for National Statistics. 2018. Aggregate land values 1995-2016.

This price inflation has systematically undermined our aspiration to live in a society with equal opportunity for all.

When people buy or rent a house, they are not only buying or renting the bricks and mortar, they are buying or renting a portion of residential land underneath. A recent study of 14 advanced economies found that 81% of house price increases between 1950 and 2012 can be explained by rising land prices (the remainder is explained by rising construction costs).[2]

As residential land values rise, communities become segregated on socioeconomic lines. Poorer households are priced out of areas with good schools, clean air, jobs, parks and public transport links.[3][4]

The higher land prices rise, the more inheritance[5] and windfall gains[6] overshadow the rewards of work. For 10 out of the last 20 years, the owner of an average house in London has reaped more in annual price growth than the average full-time UK worker earns in a year.[7]

As prices rise, more people have no option but to rent, and landlords gain increasing power to hike rents,[8] even while neglecting property maintenance. Between 2002 and 2015, housing costs for private renters grew by 16% while wages for those renters grew by just 2%.[9]

For many households, the cost of even ‘affordable’ accommodation can be borne only through painful compromises: such as putting up with damp, mould and cold; living in overcrowded conditions and accepting long commuting times.[10] These compromises affect health, child development and life chances.

Meanwhile, the 462% increase in the value of agricultural land has pushed it out of the reach of people whose primary interest is farming. Those who wish to start as farmers often discover that their likely income will not cover the interest payments on the loans required to buy land.

How did residential land prices get so high?

Although some good analyses of house and land price inflation have emerged over recent years, many politicians and commentators still repeat discredited theories: that the problem is ‘red tape’ in the planning system (see Chapter 5);[11] or immigration;[12][13] or the failure of house building to keep pace with population increases.

These theories might sound plausible. But they are not supported by the data. In fact, the Government’s own house price model suggests that even if the number of homes had grown 300,000 every year since 1996, far outstripping the growth of households, the average house today would be only 7% cheaper.[14]

This is because the balance of demand and supply in the land and housing markets is not determined only by the ratio between the number of houses and the number of households seeking somewhere to live. It is also shaped by:

- the relative attractiveness of home ownership compared to renting;

- the relative attractiveness of homes as financial assets, compared to other types of investment;

- the purchasing power with which landlords, speculators and ordinary households can support their desire to buy;

- the distribution of that purchasing power

These latter three factors have been the primary drivers of land and house price inflation in the UK over the last three decades. Here we describe the key changes that have pushed demand for houses, and therefore residential land values, to unprecedented heights.

Mortgage market liberalisation

An economic preference becomes effective demand only when it is backed up with money. This is one reason why those in most housing need (including migrants), exert the least demand in the housing market. If all house and land purchases had to be made from existing savings, the price could be bid up only so far, regardless of how desperate the bidders were to win. But most ordinary people rely on credit (mortgages from banks or building societies) when they buy a house and the land beneath it. It therefore follows that the ease with which households can obtain mortgage credit, and the cost of this credit,[15] will exert a major influence on purchasing power in the housing market, and therefore on the overall level of house and land prices.[16][17][18]

During the 1980s and 1990s there were seismic changes in the UK mortgage market – including the lifting of various restrictions on banks and building societies, the growth of securitisation,[19] and the lowering of the Bank of England base rate. The overall result was intensified competition in the mortgage market, and an increasing willingness by banks to offer riskier loans, at high loan-to-income (LTI), and loan-to-value (LTV), ratios.[20][21] In 2007, half of all mortgages had no income verification, and a third of all mortgages were interest-only.[22]

Despite measures introduced in the wake of the financial crisis that were supposed to reduce risk, the proportion of loans extended at high income multiples now far exceeds the 2007 peak.[23]

Governments have further supported the growth of mortgage lending by subsidising the cost of home purchase via various Help to Buy schemes. Analyses suggest these schemes have boosted the profits of housebuilders and pushed prices further out of reach of the many.[24]

The net result of these developments is that domestic mortgage lending has expanded from 20% of GDP in the early 1980s to over 60% now, exerting enormous upward pressure on residential land prices and creating a feedback loop between the financial system, land values and the wider economy.[25] The more credit flows to residential land, the higher house prices rise and the more credit households then need to purchase a home.

The raw deal for renters

Between 1915 and 1989, Britain, like many other countries, legislated to control rents and to ensure tenants could not be evicted without reason, enabling them to put down roots in their communities. Margaret Thatcher’s Housing Acts of 1980 and 1988 dismantled these rights. Under the Assured Shorthold Tenancies that Thatcher introduced, landlords can offer fixed-term contracts of just six months, and after that point raise rents or evict tenants without reason.

Meanwhile, a dramatic shrinking of social housing stock following the introduction of Right To Buy helped to create a captive market of households with no feasible alternative to private renting. As discussed in Labour’s Housing for the many Green Paper,[26] Thatcher presided over a major shift in housing policy, away from investment in public housing stock and towards subsidising the rents paid by lower income tenants. These are some of the reasons that rents grew so dramatically during the 80s and early 90s: housing costs tripled as a proportion of renters’ income between 1980 and 1994.[27] Today some £8 billion of housing benefit flows into the pockets of private landlords every year.[28]

These trends, in combination with plummeting interest rates after 1992, explain the dramatic divergence over the past three decades in housing costs between those who own and those who rent. Today, housing costs consume 36% of household income for renters, compared to just 12% for the average mortgaged home-owning household.[29]

These shifts affect residential land values (and therefore house prices) in two ways. First, survey data confirms that the insecurity of renting, and its relative expense compared to paying a mortgage,[30] are two reasons why British people overwhelmingly aspire to home ownership, and are willing to take on massive debts to that end. In 1975, when Thatcher became leader of the Conservative Party, 62% of people said they would prefer to be living in their own home in ten years’ time, rather than renting from the council or the private sector. By 1991, the proportion had reached 84%.[31]

But more importantly, low interest rates, high rents and the promise of easy evictions increased the appeal of Buy-to-let landlordism. People trying to escape the private rented sector have frequently found themselves in a bidding war with Buy-to-let landlords.

The Buy-to-let frenzy

The proportion of Britain’s housing stock owned by private landlords leapt from 10 percent in 2002 to 20 percent in 2015.[32] This expansion was facilitated by the introduction, in the mid-1990s, of Buy-to-Let mortgages for small-scale landlords, which assessed buyers’ credit-worthiness on the basis of rental yield from the property, rather than the buyers’ existing income. This easy finance gave landlords a significant advantage over first-time buyers,[33] and the number of outstanding Buy-to-let mortgages increased tenfold between mid-2000 and 2007.[34]

Buy-to-let landlords have also enjoyed generous tax breaks, including Mortgage Interest Relief (scrapped for ordinary households from 2000), and a Wear and Tear Allowance which did not require any proof of investment in the property. These tax breaks, in combination with the cheap finance and deregulated rents, delivered yields that were difficult to match elsewhere. The capital value rose far above the maximum that many first-time buyers could raise.

Landlord tax breaks have been reduced over recent years, and more stringent mortgage affordability tests introduced. Buy-to-let borrowing has consequently slowed, but in Q1 of 2018 still made up 23% of all lending for house purchases.[35] This additional demand is a key reason why residential land prices continue to rise in many areas.

Failures of land and property taxation

It is not only rental income that makes homes attractive as financial assets. It is also the expectation of making capital gains on the value of the land. A well designed tax system would remove this expectation, and thereby discourage people from treating homes as speculative assets. Our tax system has done the opposite.

Historically, land and property was the primary source of taxation in the UK. But there has been a shift away from the taxation of land towards flows of income and expenditure.[36] Under the UK’s current tax system, income from labour is often taxed at much higher rates than income from land and other forms of wealth.[37]

Council tax is a highly regressive and ineffective recurring tax on property that has come to resemble the unpopular poll tax it replaced.[38][39] It is based on the estimated value of the property on 1 April 1991, and therefore bears little resemblance to current market values. The poorest local authorities tend to set the highest rates, to compensate for their lower tax base and often higher needs.[40] The system is designed to ensure that the most expensive property in Band H (the highest band), no matter its value, will attract a maximum of three times the tax on the cheapest homes. As a result, those living in £100,000 homes pay around five times the tax rate of those living in £1 million mansions, as a proportion of the property’s value.[41]

Stamp Duty Land Tax is progressive, based on up-to-date property values, and levied at a higher rate on second homes and investment properties. But Stamp Duty is essentially a tax on mobility, penalising those who need to move house regularly. It is also levied on the wrong people: the purchasers, who are already having to shell out for the inflated costs of a home, rather than the sellers, who are harvesting any gains in the sale price.

Capital Gains Tax offers one means of taxing unearned gains from rising house prices, but when it was introduced in 1965 an exemption was made for primary residencies. This tax exemption, worth £28 billion in 2017-18,[42] means that those who treat their home as an alternative to investing in a pension will benefit when selling that home, by comparison to people who choose to invest in other assets.[43] Indeed, governments have actively encouraged people to accumulate assets such as housing equity, to help meet the costs of social care and retirement as the population ages.[44]

Recent changes to inheritance tax have further enhanced the tax treatment of housing, compared to other assets. In the 2015 summer Budget, the Chancellor of the Exchequer announced a new transferable main residence allowance that effectively raises the tax-free allowance from £325,000 to £500,000 per person for estates that include a house, and to £1 million for married couples.

The UK’s favourable tax treatment of home ownership helps account for its comparatively high house price volatility, and creates significant distributional advantages for homeowners, who benefit from rising real values, compared to those who rent.[45]

In certain parts of the country, particularly in London, housing has become the object of speculative investment by both domestic and foreign buyers, as rising global inequality and secular stagnation has created a glut of savings seeking a return. One in ten British adults now owns more than one home: a 30 per cent increase in the proportion of adults owning multiple properties between 2000-02 and 2012-14.[46] The annual amount of overseas finance in the UK housing market has risen from around £6 billion per year a decade ago to £32 billion by 2014. This accounts for 17% of all foreign direct investment[47] in the country.[48] A recent study estimates that house prices would be 19% lower in the absence of foreign purchases.[49]

While much of this foreign financing is legal, the London property market has also acted as a safe haven for money laundering. As Donald Toon, Head of the National Crime Agency, has remarked: “Prices are being artificially driven up by overseas criminals who want to sequester their assets here in the UK”.[50]

Again, it is worth emphasising that the overwhelming impact of these factors is not on the value of bricks and mortar, but on the value of the land beneath.

Labour has recognised the inadequacies of the UK’s system of property taxation, and has already proposed the introduction of a tax on second properties used as holiday homes, which it estimates will raise up to £560 million.[51] Labour also played a role in extending non-resident Capital Gains Tax to interests in UK commercial land and property held by non-UK-based individuals and companies.[52]

Under-utilisation of stock

It may surprise readers to learn that the number of dwellings in the UK has been growing faster than the number of households, even as house prices have been rising,[53] and that we have more bedrooms per person than ever before.[54] The simultaneous rise in housing stock, overcrowding and homelessness might seem counterintuitive, but it reflects an increasingly unequal distribution.

Census data shows that between 2001 and 2011 there was a 21% increase in homes which sit empty for most of the year, often in the most desirable seaside and inner-city locations.[55] The data suggests that this demand among wealthy elites for rural getaways and pieds-à-terre in major cities has a significant impact on local house prices,[56],[57] further depriving less wealthy people of the opportunity to buy or rent in the communities in which they have grown up.

The DCLG’s English Housing Survey 2014/5 reveals that more than half the owner-occupied homes in England have at least two bedrooms that are not regularly occupied. This represents a 31% increase in under-occupation since 1995/6.[58] Indeed, inequality measured by rooms per person is at its highest level since 1901: the richest tenth of households now have five times as many rooms per household member, compared to the worst-off tenth.[59]Rather than discouraging this inefficiency, our council tax system actually offers discounts for second homes and for single people occupying large homes, encouraging the over consumption of housing.[60]

Similarly, there are no taxes in the UK to discourage passive landowners from retaining vacant or derelict land. This has meant that, while land values rise rapidly, it can be profitable to acquire land and hold onto it rather than develop it.

How did agricultural land prices get so high?

In 2003 a new European farm payments system was adopted, that decoupled state farm subsidies from production. Instead, it rewarded landowners on the basis of how much they owned, with no ceiling on the amounts received. This appears to have triggered a rapid acceleration in the rate of agricultural land price inflation (figure 1b).[61]

Weak commodity prices and uncertainties around subsidies caused by Brexit have led to a slight fall in agricultural land values over recent years. But estate agents Savills assure buyers that “GB farmland remains an attractive investment proposition, buoyant against inflation with realisable upside from a return to capital uplift and further enhancement from diversification and/or development windfall”.[62]

The tax breaks extended to farmland are a crucial attraction. The most generous of these is the 100 per cent inheritance tax (IHT) relief on farmland and buildings, providing they were still being used for agricultural purposes when transfered on the owner’s death, or gifted to a trust. This Agricultural Relief (costing the nation £515 million annually[63]) exists ostensibly to ensure that the viability of farms is not compromised when they are inherited. However, there are no stipulations about maintaining the integrity of the business after inheritance, which means a business could be sold for cash immediately after a death.[64]

Working farms can also qualify for an Entrepreneurs’ Relief (ER) on capital gains tax, which reduces the normal rate to 10%. This tax break applies even when the farmland is being sold for development, which can result in eye-watering windfalls, since land for development can be worth 250 times more than farmland.[65] Rollover Relief is an alternative to Entrepreneurs Relief for avoiding taxation on development land profits and is available when the proceeds from the disposal of land are reinvested into the replacement asset.

It is no wonder, therefore, that estate agents promote farmland as a “safe shelter for wealth and a tax-efficient means of transferring wealth from one generation to the next”.[66] In 2017 only 40% of farm purchases were by farmers.[67]

Macroeconomic implications

The factors outlined above – a huge expansion in cheap, easy mortgage credit, the high levels of speculative demand from Buy-to-let landlords and domestic and foreign elites, the shrinking of our social housing stock and many people’s desperation to escape the exploitation and insecurity of the private rented sector – have all conspired to push house prices to unprecedented heights. According to OECD data, the UK has seen a 56.6% jump in its house price-to-income ratio over the past thirty years, the second-biggest behind Canada.[68]

We have already noted that these trends have systematically undermined the vision of a society with equal opportunity for all. But there are several other pernicious effects.

By allowing people to make unprecedented windfall gains through speculative investments in land and property, we discourage them from making productive investments in the economy.

By squeezing the budgets of the poorest people through higher housing costs, we make aggregate demand in the economy more and more dependent on debt – both consumer credit, and home equity withdrawal. This leaves people more exposed, both to a change in interest rates and to a fall in house prices. Almost 80% of new mortgage lending in 2016 was either on a fixed rate for a period of less than five years or on a floating rate.[69] And, according to the Council for Mortgage Lenders, around a fifth of all residential mortgages in the UK are interest-only.[70]

By failing properly to regulate mortgage lending and to discourage the use of houses as financial assets, we make our economy vulnerable to a deep and sudden reversal in house prices. This is because the feedbacks between mortgage lending, land prices, and speculative behaviour, that push prices up during a boom, work just as powerfully in reverse. Faltering house prices tend to make both potential borrowers and mortgage lenders more cautious, which has the effect of sucking demand out of the housing market.[71] Bank lending thus adds an elasticity to demand, which, if not carefully managed, creates more dramatic booms and deeper slumps. Similarly, as the Bank of England has repeatedly warned, the behaviour of leveraged investors tends to amplify house price movements during a downturn (by withdrawing their demand suddenly), just as they do during the upswing.[72]

Finally, when housing bubbles burst, the presence of high levels of mortgage debt in the economy result in a deeper downturn in the wider (non-housing) economy. The more leveraged a household, the more likely it is to make deep cuts in spending following a downturn in house prices, sucking demand out of the whole economy.[73] [74]

Learning our lessons

Could the inequality and instability that we have experienced from our land system have been predicted? The power of landowners to enjoy flows of rents and asset price appreciation disproportionate to their efforts – indeed, to demand an ever increasing share of society’s surplus – was a major preoccupation for political economists of the 19th century, from David Ricardo (1815), to John Stuart Mill (1848), to Henry George (1879).[75] And the problems we explore were explained by Hyman Minsky’s financial instability hypothesis in 1986.[76] Indeed, before the financial crisis, there were predictions – notably from central bankers[77][78][79] as well as Minskians and other Post-Keynesian researchers[80][81] – that the deregulation of mortgage credit would lead to rapidly inflating land and house prices, and a likely housing bubble and/or debt crisis.

Fortunately, the 2008 financial crisis, and the widening gap between those who own property and those who do not, have prompted a reawakening in the economics profession, both to the role of bank credit and speculative demand in asset price instability, and the significance of land rent extraction as a powerful driver of inequality. It is time for these academic insights to influence policy making.

Recommendations

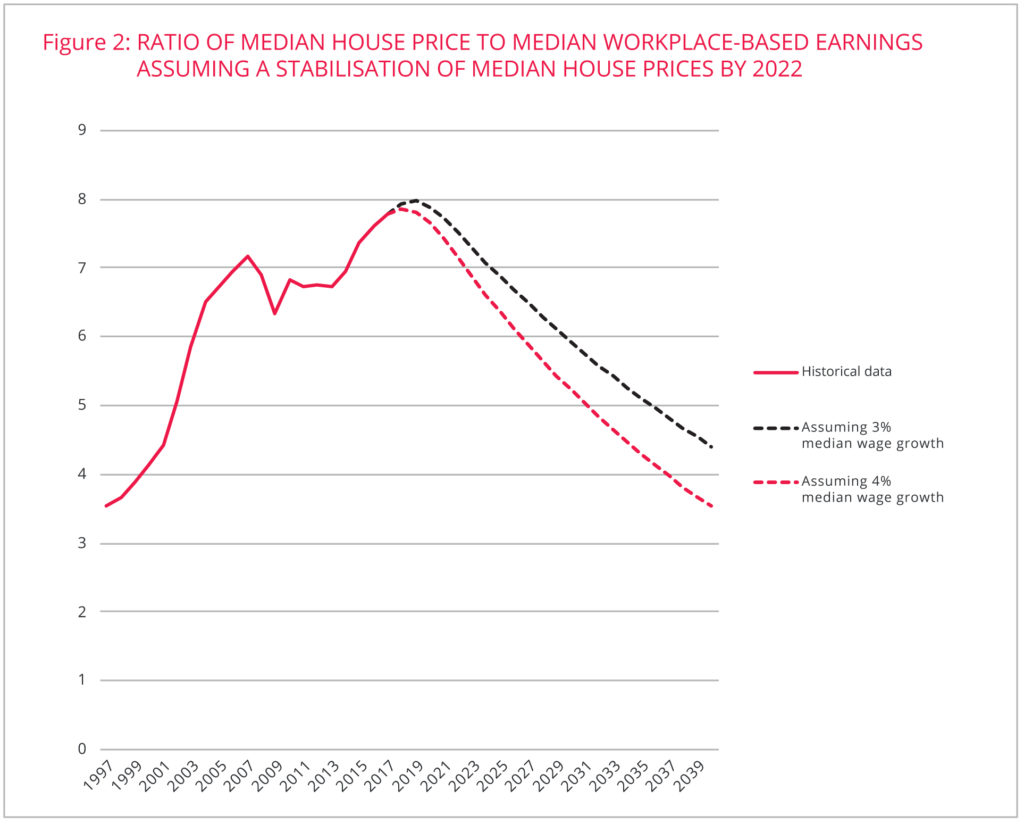

We recommend that a Labour government set an explicit goal of stabilising land and house prices, so that wages can catch up and the house price-to-income ratio gradually return to its historic norm (figure 2). To achieve this goal, we will need bold policies, particularly to bring rents under control, and rein in speculative, debt-fuelled demand.

Expand social housing

There is clearly a need for an ambitious social house building programme, as set out in Labour’s Green Paper, Housing for the Many.[82] In Chapter 5 we offer additional detail on how changes to land compensation laws could support this goal.

Obviously an increase in the availability of social housing will be a lifeline to the 1.2 million people on the social housing waiting list in England. If sufficiently ambitious, a social house building programme could also reduce pressure and improve tenant bargaining power in the private rented sector. Falling private sector rents would, in turn, feed through eventually into lower house prices. But we should not expect such an effect to be either significant or swift, partly because there are major skills shortages in the building sector,[83] partly because there is a huge backlog of housing need,[84] and partly because, as discussed above, there are a range of other more powerful forces, besides supply shortages, putting upward pressure on house prices.

Reform of the private rented sector

Measures to end the insecurity and exploitation experienced by private renters make sense on their own terms, as the constant threat of rent hikes and evictions is affecting the health, relationships and life chances of millions of people.[85][86] They have the additional benefit of dampening demand from Buy-to-let buyers, and therefore removing one of the key drivers of residential land price inflation.[87]

In response to a sustained campaign by renters rights organisations, both Theresa May and Mark Drakeford, first minister of Wales, recently announced that they would bring an end to ‘no fault evictions’ in England and Wales. In practice this involves scrapping Section 21 of the 1988 Housing Act which gives landlords the power to evict a tenant without giving any reason. Scotland already abolished Section 21 and introduced a new system of open ended tenancies in December 2017 that could offer lessons for the other UK nations. We recommend that Labour go further than Scotland to ensure greater security for renters.

As Labour’s Shadow Housing Secretary has pointed out,[88] without caps on rent increases, the scrapping of Section 21 will not be fully effective, since landlords will be able to use unaffordable rent hikes as an effective alternative to retaliatory eviction. At a minimum we recommend a cap on annual permissible rent increases within tenancies, at no more than the rate of wage inflation or consumer price inflation (whichever is lower). Mutually agreed rent increases would be permitted under such a cap: for example, to cover the costs of refurbishments beyond those required under law, and landlords would still be able to set the rent at any level when advertising the property for rent to new tenants. A cap on rent increases within tenancy, when rents are already unaffordable in many areas, may sound of modest help to tenants, but in combination with the removal tenants’ liability of council tax (see below), it should result in an overall reduction in housing costs for most private renters.

We further recommend that the permitted grounds for eviction within the first three years of a tenancy should be more limited than they are under the reformed system in Scotland[89], excluding, for instance, a right to repossess the property in order to sell or renovate.[90] We recommend increased eviction notice periods. Two fifths of private tenants (41%) report that the current two-month notice period is too short to allow them to find a new place to live.[91] We also propose compensation (equivalent to three months rent) for tenants who are forced to move through no fault of their own. This would incentivise landlords to sell to sitting tenants or sell the property as tenanted to another landlord where possible. It is paramount that such protections are in place before any broader housing market changes are enacted that could trigger landlords to sell.

We also support calls for a national register of landlords,[92] a ‘property MoT’ to ensure homes in the private rented sector are safe and decent,[93] and an end to landlords’ exemption from meeting the Energy Performance Certificate of E if there are upfront costs of more than £3,500.[94],[95]

These reforms would be electorally popular and bring the UK in line with the kind of protections that renters enjoy in many other European countries.[96][97] They would also discourage further demand from Buy-to-let landlords, which is essential to meet our goal of stabilising house prices.

Reform taxation of land and property

The UK’s current system of residential property taxation is regressive, arbitrary and economically inefficient. The following reforms, by contrast, are designed to:

- Discourage the use of homes for speculation and rent extraction, and thereby help to stabilise land prices;

- Reduce the amount of unearned windfall gains that are privately captured, and make those wealth increases available to cover the health and welfare costs of an aging society;

- Reduce the level of taxation on the majority of households, and boost disposable incomes for the bottom half of the income distribution;

- Prompt the more efficient use of the housing stock, by reducing the number of homes left vacant or empty, and encouraging people to downsize where possible.

Replacing Council Tax with a Progressive Property Tax

We recommend that a Labour government replace the regressive and unpopular council tax with a progressive property tax based on contemporary property values. Unlike council tax, this tax would be payable by owners, not tenants. This would result in significant administrative savings, lower levels of arrears and less court action. Unlike council tax, the progressive property tax rate would be based on regularly updated property values,[98] and the rates would be set nationally, rather than locally determined. The level of redistribution between local authorities would need to increase substantially under this system, to ensure that the local authorities with high social needs and low land values are not left dependent on central government grants. However, there could be a tax free allowance that varied regionally so as to make, for example, the least valuable 10 percent of properties in each region tax-free. Progressivity should be further improved by levying a progressively higher rate of taxation on each of the top 4 deciles of property by value.

In line with Labour’s existing plans for council tax,[99] we recommend that the new progressive property tax be levied at a significantly higher rate on second homes and empty homes,[100] to encourage a more efficient use of the housing stock. Further, we recommend that homes classed as ‘main residences’ but owned by people who are are not domiciled in the UK for tax purposes (‘non doms’) should carry a similar surcharge.[101] The Annual Tax on Enveloped Dwellings discussed below should discourage people from using corporate ‘wrappers’ to avoid such a surcharge.

Vacant and derelict residential land (that the council tax currently exempts) would be brought into this system, to discourage land hoarding.

Such a progressive property tax could generate more revenue, encourage the more efficient use of the housing stock, leave the large majority of households better off,[102] and boost average disposable incomes for the least wealthy half of population.[103] To further sweeten this tax change we recommend that Stamp Duty Land Tax[104] be phased out for people buying homes to live in themselves, since it unfairly penalises people who need to move house.[105] It should remain in place, however, for dwellings purchased by ‘non doms’, companies, and all second homes and investment properties.

Special arrangements will need to be made for current landlords for whom cash flow problems may arise from the combination of higher tax liabilities and rent caps which prevent them passing the costs on to tenants. We propose that where the extra tax liability would leave landlords unable to cover maintenance costs, landlords should be permitted to roll over a portion of their tax liabilities and pay upon sale out of their capital gains. The rolled over tax bill could be capped so that landlords are not forced to pay more in tax than they have gained in house price appreciation.

Taxing Offshore Ownership

We support Labour’s proposed Offshore Company Property Levy[106] but suggest it is extended beyond residential property. Thus we recommend a 15% tax on the price of any land or real estate when purchased by companies directly, or indirectly, owned in secrecy jurisdictions.[107] We also recommend an increase in the Annual Tax on Enveloped Dwellings (ATED) and a removal of the exemption for properties under £500,000.[108] It is important, however, that housing cooperatives, who share democratic ownership and control of their housing, are granted relief from ATED.[109] In Chapter 2 of this report, we also call for greatly increased transparency around land owned by corporate entities and trusts, including compulsory publication of the beneficial owners of such entities.

Sharing Unearned Capital Gains

We recommend that the rate of capital gains tax for second homes and investment properties be increased so that it is at least in line with income tax rates (currently 20% for basic rate payers, 40% for higher rate taxpayers) to encourage people to seek more productive and socially beneficial ways to invest their money.[110] Taxing income derived from asset price appreciation, which requires no work to obtain, at a lower rate than income derived from labour, which requires significant exertion on the part of the worker, is intuitively unfair. The top rate of tax should also apply in case of property owned by ‘non doms’, companies, and non-residents.

Applying a capital gains tax to main residences too would allow us to limit the wealth inequality arising from the housing boom, but would be controversial and would make it difficult for some households to buy properties of equivalent value when moving house. The reforms to Inheritance Tax outlined below are designed to allow for the better sharing out of the unearned windfalls arising out of the housing boom.

Replacing Inheritance Tax with a Lifetime Gifts Tax

In the long term we recommend that inheritance tax should be abolished, and replaced with a lifetime gifts tax levied on the recipient, as has recently been proposed by the Resolution Foundation[111] and IPPR.[112] Under this system, tax would be levied on the gifts received above a lifetime allowance of £125,000. When this lifetime limit is reached, any income from gifts would be taxed annually at the same rate as income derived from labour under the income tax schedule. The Resolution Foundation estimate that taxing gifts through the income tax system would raise £15 billion in 2020/21, £9.2 billion more than the current inheritance tax system, and would do so more progressively.

Under IPPR’s proposal there would be conditional exemptions for business and agricultural property, under which tax could be deferred until the asset is sold or until the business ceases to be a trading entity and becomes an investment entity. This would allow families to maintain the integrity of agricultural land or business assets, but would also prevent inheritees from gaining large tax-free windfall gains. We believe that the cost and benefits of such an exemption need to be considered as part of the post-Brexit redesign of agricultural subsidies. In Chapter 8 we make the case for an English Land Commission to review the tax and subsidy regime for agricultural land, and offer some guidance on the issues to be taken into consideration by such a commission.

Since implementing a lifetime gifts tax may take time, Labour’s plans to reverse the Conservative government’s recent inheritance tax break for main residences is an important interim step.[113] Further, we recommend that a tax be introduced for equity withdrawals, which is a key means of avoiding inheritance tax.

Replacing business rates with a Land Value Tax

Finally, we recommend that business rates be replaced with a Land Value Tax. This policy is already under consideration by Labour,[114] and has been embraced by numerous recent reviews.[115][116][117][118][119] We suggest that this tax be calculated on the basis of the rental value,[120] and that vacant and derelict land be brought into this regime, to discourage hoarding (once residential planning permission had been granted, the property tax would apply). Taxing land is recognised to be one of the most economically efficient way of raising taxes, not distorting but rather supporting investment and productive activity.[121] It also provides a means for recovering the unearned windfalls from collective development for the state and wider community, and encourages efficient land use by creating less incentive for developers to hoard undeveloped land. For the sake of simplicity and progressivity, and to reduce opportunities for tax avoidance, there may be a case for this land value tax being extended to agricultural land too. The entire system of taxes and subsidies for agriculture needs to be considered as a whole, as we propose in Chapter 8.

Holiday home restrictions

We recommend that two new categories of Use Class under the Town and Country Planning (Use Classes) Order 1987 (as amended) are introduced for second homes and furnished holiday lettings. Residential dwellings are currently categorised as C3 or C4. We proposed the following categories:

- C5 – Second Homes in which there is no permanent resident (a number of tests including entries on the electoral register, and the type of insurance cover, could be devised to police this);

- C6 – Furnished Holiday Lettings. These are already defined in detail under income tax rules.

Use of a building as C5 or C6 would require planning permission. Local authorities should be required to set out a strategy for the proportion and location of C5 and C6 properties in their area in order to give some guidance to individual case decisions. Factors to be considered would be the need to balance the requirements of the tourist and leisure industries with the housing needs of local residents, and to maintain sufficient density of permanent residents to support vital infrastructure such as schools, shops, pubs and post offices.

C5 and C6 permissions should be time-limited to 5 years to allow the proportion of C5 and C6 properties to be varied over time to adapt to changing circumstances.

We recommend that all existing second homes and Furnished Holiday Lettings properties will need to gain planning permission, with no exemptions based on current use. However, this could be phased in over an extended period to allow for orderly sales of second homes and Furnished Holiday Lettings properties that fail to gain C5 or C6 permissions. It may be possible to design the system for allocating permissions so that it raises revenue too.[122]

Better macroprudential supervision of bank lending

We propose that the Bank of England’s mandate be expanded, to include a target to stabilise house prices.[123] Alterations to the Bank of England’s base rate – the Bank’s conventional approach for influencing aggregate borrowing – will be unsuitable for achieving this goal. Pushing interest rates higher may slow the pace of mortgage borrowing, but it can also deter investment in productive sectors.[124][125] Rather than price-based disincentives for borrowers, we therefore recommend that the Bank of England make positive use of quantitative measures such as credit guidance and other macroprudential tools to encourage a shift in bank lending away from real estate and other inflationary and non-productive forms of lending, and toward more strategically useful sectors of the economy.

As discussed in GFC and Clearpoint’s recent report for the Shadow Chancellor, banks currently have a strong incentive to lend against housing collateral, since capital requirements for mortgage loans are lower than for other types of lending, including loans to small business, collateralised by commercial property.[126] This bias could be reversed by, for example, raising the risk-weightings for mortgage lending, and lowering the risk weightings for productive forms of lending, or by enforcing a maximum ratio of mortgage lending to productive lending. Reducing the house price-to-income ratio will have strong distributional benefits by widening access to housing. However, additional measures may be needed to prevent tightening mortgage access disproportionately impacting on poorer households.

Once house prices are stabilised, and the house price-to-income ratio starts to fall, we recommend that the maximum loan-to-income and loan-to-value ratios should be correspondingly tightened, to prevent any future debt-fuelled reinflation of house prices. Relaxed borrowing requirements are popular among aspiring home owners, since – on a micro level – they appear to increase the opportunities for poorer households to benefit from home ownership. However, at a macro level, easy access to housing finance adds to aggregate purchasing power, and exerts upward pressure on prices. If everybody is standing on tiptoes, nobody gets a better view.

If, in spite of the improvements to tenants’ rights and property tax outlined above, first time buyers continue to be outbid by prospective landlords, Labour should more heavily regulate or reduce the availability of Buy-to-let mortgages, by requiring borrowers would need to show their existing income was sufficient to cover monthly mortgage costs. Arguably, it is unfair for first time buyers to have to compete against purchasers able to rely on projected rental income. Regulating or reducing Buy-to-let mortgages would dampen speculation-driven house price increases.

Preventing a destabilising fall in house prices

The recommendations above will curtail the feedbacks that put upward pressure on residential and agricultural land prices. Achieving the goal of land price stabilisation, however, will require attention not only to the feedbacks pushing prices up, but also the potential feedback loops that could push prices down.

Any reform that makes residential land and property less attractive as financial assets could prompt investor flight, which would exert downward pressure on prices. Although many aspiring homeowners would welcome this, the risks associated with falling prices must be avoided. In particular, a big decrease in residential land prices would be punishing for households who bought for the first time at the height of the boom, and could push some into negative equity, making it difficult either to move house or to re-mortgage.

A lack of preparedness for dealing with these risks is a major barrier to reform. In the next chapter we offer one possible way to overcome this barrier.

Next: Chapter 4: The Common Ground Trust »[1] Office for National Statistics, 2017. UK National Balance Sheet Estimates.

[2] K. Knoll, M. Schularick, and T. Steger, 2017. No price like home: global house prices, 1870–2012. The American Economic Review 107: 331–353.

[3] J. Muellbauer, 2018. Housing, Debt and the Economy: A Tale of Two Countries, National Institute Economic Review 245, August: R20–33.

[4] S. Gibbons and S. Machin, 2008. Valuing school quality, better transport, and lower crime: evidence from house prices. Oxford Review of Economic Policy, 24 (1), 99–119.

[5] R. Joyce and A. Hood, 2017. Inheritances and Inequality across and within Generations. Institute for Fiscal Studies.

[6] C. D’Arcy and L. Gardiner, 2017. The Generation of Wealth: Asset Accumulation across and within Cohorts, Intergenerational Commission Wealth Series, Resolution Foundation.

[7] Land Registry Data and Annual Survey of Hours and Earnings.

[8] The relationship between house prices and rents actually operates in both directions, in that the expected stream of future rental income influences land prices too.

[9] S. Clarke, A. Corlett, and L. Judge, 2016. The Housing Headwind: The Impact of Rising Housing Costs on UK Living Standards, Resolution Foundation.

[10] Office of National Statistics, 2014. What Does the 2011 Census Tell Us about Concealed Families Living in Multi-Family Households in England and Wales?

[11] This view has been the subject of some robust criticism from planners, who point out that far more land is allocated for development in plans than is actually developed. See D. Bowie, 2010. Politics, planning and homes in a world city: the Mayor of London and strategic planning for housing in London 2000-2008, London: Routledge; J. Sarling and R. Blyth, 2013. Delivering Large Scale Housing: Unlocking Schemes and Sites to Help Meet the UK’s Housing Needs, London: RTPI.

[12] Over 60 per cent of British voters claim that immigration is the cause of the housing crisis – higher than any other explanation. The Observer, 2016. UK housing crisis: poll reveals city v country split on who to blame.

[13] Interestingly, a study published in the Economics Journal found that an increase of immigrants equal to 1% of the initial local population actually leads to a 1.7% reduction in house prices. F. Sá, 2015. Immigration and House Prices in the UK, The Economic Journal 125, no. 587, September 1: 1393–1424.

[14] These results are in line with other studies, including from the Office of Budgetary Responsibility, the OECD, G. Meen at Reading University, and Oxford Economics for the Redfern Review, 2016. See I. Mulheirn, 2018. What Would 300,000 Houses per Year Do to Prices?, Medium (blog), April 20.

[15] It is worth stressing that comparisons with other developed countries experiencing low interest rates show that low interest rates alone do not explain the growth of mortgage credit in the UK. Other institutional factors are critical. See J. Ryan-Collins, T. Lloyd and L. Macfarlane, 2017. Rethinking the Economics of Land and Housing. Zed Books, pp. 156-157.

[16] J. Muellbauer, 2018. Housing, Debt and the Economy: A Tale of Two Countries, National Institute Economic Review 245, no. 1 August: R20–33.

[17] J. Ryan-Collins, T. Lloyd, and L. Macfarlane, 2017. Rethinking the Economics of Land and Housing, London: Zed Books.

[18] G. Turner et al., 2018. Financing Investment: Final Report, GFC Economics Ltd & Clearpoint Advisors Limited.

[19] Securitisation is the practice of pooling together and repackaging a number of loans and issuing tradable debt securities sold to investors that will be repaid as the underlying loans are reimbursed. In many cases the loans used to back the tradable securities are mortgage loans (residential or commercial) – in these instances the securities are called ‘Mortgage Backed Securities’ (MBS).

[20] T. Dolphin and M. Griffith, 2011. Forever Blowing Bubbles? Housing’s Role in the UK Economy, London: IPPR.

[21] J. Ryan-Collins, T. Lloyd, and L. Macfarlane, 2017. Rethinking the Economics of Land and Housing London: Zed Books.

[22] Financial Services Authority, 2009. Mortgage Market Review 09/3: Discussion Paper London: FSA.

[23] The proportion of loans with LTI ratios between 4.0 and 4.5 has almost doubled since the pre-crisis credit peak in 2007 (from 8.95% to 17.65%), while the share of LTI≥4.5 has also risen from 6.50% to 10.65%. G. Turner et al., 2018. Financing Investment: Final Report, GFC Economics Ltd & Clearpoint Advisors Limited, June 20, p.54.

[24] P. Collinson, 2017. Help to buy has mostly helped housebuilders boost profits, The Guardian, October 21st.

[25] J. Ryan-Collins, T. Lloyd, and L. Macfarlane, 2017. Rethinking the Economics of Land and Housing, London: Zed Books.

[26] Labour Party, 2018. Housing for the Many. Green Paper.

[27] C. Belfield, J. Cribb, A. Hood, R. Joyce. Living standards, poverty and inequality in the UK: 2014. Institute for Fiscal Studies, 26.

[28] This is in spite of severe cuts in the generosity of Housing Benefit, which have reduced the expense to the taxpayer but at the cost of increased financial stress for many tenants. See L. Judge and D. Tomlinson, 2018. Home Improvements: action to address the housing challenges faced by young people, Resolution Foundation Intergenerational Commission.

[29] A. Corlett and L. Judge, 2017. Home Affront. London: Resolution Foundation, 30.

[30] The expense of home ownership was further reduced by the introduction of Mortgage Interest Relief at Source in 1983, which which gave borrowers tax relief for interest payments on their mortgage.

[31] B. Pannell, 2016. Home-Ownership or Bust? Consumer Research into Tenure Aspirations, Council of Mortgage Lenders, October, p. 46.

[32] Office of National Statistics, Live Table 102: Dwelling stock (including vacants) by tenure, Great Britain.

[33] P. Saunders, 2016. Restoring a Nation of Home Owners: What Went Wrong with Home Ownership in Britain, and How to Start Putting It Right, London: Civitas.

[34] HM Treasury, 2010. Investment in the UK private rented sector, February.

[35] FCA. 2018. Mortgage Lending Statistics.

[36] For example, Schedule A was a tax payable by homeowners on ‘imputed rent’ – the extra disposable income that home owners benefit from as a result of not paying rent. It formed part of the tax regime from the Napoleonic Wars until it was scrapped in 1963.

[37] C. Roberts, G. Blakeley, and L. Murphy, 2018. A Wealth of Difference: reforming the taxation of wealth. IPPR, Discussion paper.

[38] A. Corlett and L. Gardiner, 2018. Home Affairs: options for reforming property taxation. Resolution Foundation.

[39] L. Murphy, C. Snelling and A. Stirling, 2018. A poor tax – Council tax in London: Time for reform, IPPR.

[40] J. Muellbauer, Housing, 2018. Debt and the Economy: A Tale of Two Countries, National Institute Economic Review 245, August: R20–33

[41] A. Corlett and L. Gardiner, 2018. Home Affairs: options for reforming property taxation. Resolution Foundation, March.

[42] Resolution Foundation, 2018. UK’s £155bn tax relief bill costs more than health, transport, justice, home and foreign office budgets combined. Press Release, 23 January 2018.

[43] See also Guardian, 2016. ‘Property is better bet’ than a pension says Bank of England economist. The Guardian, 28 Aug.

[44] J. Doling and R. Ronald. 2010. Home Ownership and Asset-Based Welfare. Journal of Housing and the Built Environment 25, 165–173.

[45] M. Oxley, and H. Marietta, 2010. Housing Taxation and Subsidies: International Comparisons and the Options for Reform, York: Joseph Rowntree Foundation Housing Market Taskforce.

[46] Resolution Foundation, 2017. 21st Century Britain has seen a 30 per cent increase in second home ownership. Press Release, 19 August 2017

[47] ‘Investment’ in such cases, is, or should be, a contentious term. This word is used to mean two quite different things: the funding of productive and socially useful activities, and the purchase of existing assets to extract rent, interest, dividends and capital gains. Much of the foreign direct ‘investment’ in housing falls into the latter category.

[48] A. Armstrong, 2016. Commentary: UK Housing Market: Problems and Policies. National Institute Economic Review, 235 (1), F4–F8.

[49] F. Sá, 2016. The Effect of Foreign Investors on Local Housing Markets: Evidence from the UK. Centre for Macroeconomics Discussion Paper.

[50] J. Evans, 2018. How laundered money shapes London’s property market. Financial Times, April 6, 2016

[51] M. Savage. Radical Labour levy would double council tax on holiday homes. The Observer.

[52] S. Creasy, 2017. This egregious tax loophole costs the UK £8bn every year. Let’s close it. The Guardian, 30 Oct.

[53] In 1991 there were 3.0% more dwellings than there were households in the UK according to government data. Today there appear to be 5.2% more places to live than there are households. We must be cautious about concluding from this that there is a no housing shortage of any type, in any area. Indeed, there is evidence that the rate of household formation has itself been constrained by high house prices. See N. Mcdonald & P. Williams, 2014. Planning for housing in England: Understanding recent changes in household formation rates and their implications for planning for housing in England. Royal Town Planning Institute.

[54] D. Dorling, 2014. All that is Solid: The Great Housing Disaster. London: Penguin.

[55] The overall number of properties in England and Wales recorded as having “no usual resident” increased by 21% between 2001 and 2011. Source: Census tables KS401EW and KS016.

[56] Based on 2005 data, a study by Prof. Glen Bramley and colleagues concluded that second homes were responsible for raising prices by more than 10 per cent in 11 local authorities, and by more than 5 per cent in 28 local authorities. Brown, T., Lishman, R. and Oxley, M., Turkington, R., 2008. Rapid evidence assessment of the research literature on the purchase and use of second homes. London: The National Housing and Planning Advice Unit.

[57] Savills report that in the five parishes of Cornwall where second homes account for more than 35% of all housing, the average house price is 87% above the county average – a premium which falls to 46% where second home ownership is between 20% and 30% and further to 23% where it is between 10% to 20%. L. Cook, 2013. Seconds out on second homes. Savills, Research article, 20 May 2013.

[58] T. Murphy, 2018. Why are so many of the UK’s homes under occupied?, RSA.

[59] B. Tunstall, 2015. Relative housing space inequality in England and Wales, and its recent rapid resurgence, International Journal of Housing Policy, 15 (2), 105–126.

[60] J. Mirrlees et al, 2011. Tax by design, IFS.

[61] RICS, 2018. Price Expectations deteriorate further. RICS/RAU, Rural Land Market Survey H1 2018.

[62] I. Bailey and A. Lawson, 2018. Spotlight: GB Agricultural Land 2018. Savills.

[63] A. Corlett, 2018. Passing on. Options for reforming inheritance taxation. Resolution Foundation.

[64] C. Roberts, G. Blakeley, and L. Murphy, 2018. A Wealth of Difference: reforming the taxation of wealth. IPPR, Discussion paper. P. 26

[65] P. Hetherington, 2015. Britain’s farmland has become a tax haven. Who dares reform it? The Guardian, 2 Sep.

[66] I. Bailey and A. Lawson, 2016. Global Market Tips. Savills, Research Article, 24 February 2016

[67] I. Bailey and A. Lawson, 2018. Spotlight: GB Agricultural Land 2018. Savills.

[68] G. Turner, P. Rice, S. Jones, M. Harris, E. Applebee, and C. Philip, 2018. Financing Investment: Final Report. GFC Economics Ltd & Clearpoint Advisors Limited.

[69] Bank of England, 2017. Financial Stability Report June 2017, Bank of England, 4.

[70] Tatch, J., 2017. Interest-only: coaxing the cat out of the bag. Council of Mortgage Lenders, 15 May.

[71] C. Goodhart and B. Hofmann, 2008. House Prices, Money, Credit and the Macroeconomy, Working Paper Series, European Central Bank, April. J. Muellbauer and A. Murphy, Housing Markets and the Economy: The Assessment, Oxford Review of Economic Policy 24, no. 1 (2008): 1–33. Available from: //doi.org/10.1093/oxrep/grn011.

[72] Bank of England, 2017. Financial Stability Report June 2017, 6-7.

[73] Bunn, P. and Rostom, M., 2015. Household debt and spending in the United Kingdom. Bank of England, Staff Working Paper No. 554.

[74] A. Mian and A. Sufi, 2014. House of Debt. University of Chicago Press.

[75] B. Fried, 1998. The Progressive Assault on Laissez Faire: Robert Hale and the First Law and Economics Movement. New Edition. Cambridge: Harvard University Press.

[76] H.Minsky, 1986. Stabilizing an unstable economy. Yale University Press.

[77] R. Adalid, and C. Detken, 2007. Liquidity shocks and asset price boom/bust cycles. Frankfurt: European Central Bank.

[78] C. Borio, and P. Lowe, 2004. Securing sustainable price stability: should credit come back from the wilderness? Basel: Bank for International Settlements.

[79] C. Detken, and F. Smets, 2004. Asset price booms and monetary policy. Frankfurt: European Central Bank.

[80] S. Keen, 2013. Predicting the ‘Global Financial Crisis’: Post-Keynesian Macroeconomics. Economic Record, 89.

[81] D. J. Bezemer, 2009. No one saw this coming. Understanding financial crisis through accounting models. University of Groningen, Research Institute SOM (Systems, Organisations and Management), Research Report No. 09002.

[82] Labour Party, 2018. Housing for the Many. Green Paper.

[83] T. Wallace, 2017. Skills shortage tightens around UK construction sector. The Telegraph, 16 Nov.

[84] It is estimated, based on the Labour Force Survey, that the number of concealed households in the UK – that is, family units without their own home – rose by 50 percent in the past decade, from 1.6m in 1996, to 2.5m households in 2016. S. Aldridge, 2018. The housing market: challenges and policy responses, National Institute Economic Review, 245.

[85] Evictions are the number one cause of homelessness. Shelter, 2017. Eviction from a Private Tenancy Accounts for 78% of the Rise in Homelessness since 2011. Press Release, March 23, 2017.

[86] Even for those unlikely to be made homeless, the threat of eviction can mean constant anxiety and insecurity. Shelter, 2017. Unsettled and Insecure: The Toll Insecure Private Renting Is Taking on English Families.

[87] J. Muellbauer, 2018. Housing, Debt and the Economy: A Tale of Two Countries, National Institute Economic Review 245, no. 1, August: R20–33.

[88] Labour, 2019. John Healey responds to the government’s pledge to protect tenants against unfair eviction. Monday 15 April 2019.

[89] Scottish government, 2017. Private residential tenancy: information for landlords: Guidance for private sector landlords on the Private Housing (Tenancies) (Scotland) Act 2016.

[90] As a recent IPPR report notes, 62 per cent of no fault evictions are served to enable landlords to sell their property or to use the property themselves. This additional protection would not prevent landlords from selling their property with sitting tenants. See D. Baxter and L. Murphy, 2019. Sign on the dotted line? A new rental contract. IPPR.

[91] DCLG, 2016. English Housing Survey 2014-15: Private Rented Sector Report, Table 3.3

[92] Generation Rent, 2014. The easy way to implement a national register of landlords.

[93] D. Baxter and L. Murphy, 2019. Sign on the dotted line? A new rental contract. IPPR.

[94] Fuel Poverty Action, 2018. Minimum Energy Efficiency Standards (MEES) in private sector housing: FPA response to BEIS Consultation.

[95] Contrary to the scaremongering of many landlord lobbyists, the evidence suggests that such measures will have no adverse impact on rents. D. Wilson Craw, 2018. Do measures that discourage buy-to-let investment increase rents? Generation Rent.

[96] D. Baxter and L. Murphy, 2019. Sign on the dotted line? A new rental contract. IPPR.

[97] Generation Rent, 2016. Secure tenancies, strong families, stable communities: reforming private renting.

[98] Revaluations should not take account of improvements made by homeowners themselves, only changes in property values that arise from wider market conditions.

[99] Michael Savage, 2018. “Radical Labour Levy Would Double Council Tax on Holiday Homes,” The Observer, September 23, 2018

[100] This rate may need to be gradually raised to ensure that the house price to income ratio continues to fall back to its historical norm.

[101] This is not ‘anti-foreigner’ because non-UK citizens who choose to make the UK their tax domicile, bringing their worldwide income and assets within the remit of UK taxation, would not be penalised. T. Greenham, 2016. Why only UK taxpayers should own UK homes. RSA.

[102] It is important to consider how households previously eligible for council tax exemptions can be supported when starting new tenancies at potentially higher rents.

[103] A. Corlett and L. Gardiner, 2018. Home Affairs: options for reforming property taxation. Resolution Foundation, March 2018.

[104] In Scotland, Stamp Duty Land Tax (SDLT) was replaced by the Land and Buildings Transaction Tax (LBTT) in 2015. However, as the LBTT suffers from many of the same shortcomings as SDLT, we recommend that the Scottish Government abolishes LBTT for people buying homes to live in themselves.

[105] The overnight scrapping of Stamp Duty Land Tax would lead to a sudden jump in house prices. It may be prudent to keep a portion of the up front payment in place, but have it gradually refunded to buyers, through tax relief on their annual progressive property tax.

[106] Labour Party, 2018. McDonnell demands Hammond introduce almost £1bn “Oligarch Levy” to hit Russian tax dodgers. Press Release, 18th March 2018.

[107] This would encompass a ban on land owned by UK companies whose beneficial owners are based in secrecy jurisdictions. It would be in addition to Stamp Duty Land Tax due.

[108] We suggest this increase because ATED at its current levels has had little impact. In August 2015, 97,573 titles were registered at Land Registry as being owned by overseas companies. In October 2018, 96,882 titles remained registered to overseas companies, a fall of only 0.7%, despite a significant increase in the Annual Tax on Enveloped Dwellings over the period, suggesting that ATED to date has had little effect on overseas ownership. Source: Land Registry’s Overseas Companies dataset.

[109] Housing co-operatives have very good reasons for owning residential property via corporate structures that have nothing to do with the tax avoidance practice known as enveloping. Cooperatives UK have proposed a relief for housing cooperatives from this tax that would provide at least the same level of protection against tax avoidance that is found in the existing reliefs (e.g. for property rental businesses). See J. Wright, R. Morris and G. Guerin, 2018. ATED and Higher-Rate SDLT: creating reliefs for non-registered-provider housing co-operatives. Cooperatives UK.

[110] The IPPR have proposed scrapping the entire capital gains system and incorporating income from asset price appreciation (as well as income from dividends) into the income tax schedule. In general we think this is a sensible proposal, but if the government went down this route, it would need to impose an even higher annual property tax premium for second homes/empty homes than we outline here, since the capital gains tax regime would no longer discourage investment in second homes relative to more productive forms of investment. Roberts, C., Blakeley, G., and Murphy, L., 2018. A Wealth of Difference: reforming the taxation of wealth. IPPR, Discussion paper, p. 2.

[111] A. Corlett A, 2018. Passing on: options for reforming inheritance taxation, Resolution Foundation.

[112] C. Roberts, G. Blakeley, and L, Murphy, 2018. A Wealth of Difference: reforming the taxation of wealth. IPPR, Discussion paper.

[113] Labour Party, 2017. Funding Britain’s Future.

[114] A. Perkins, A., 2018. Labour says land value tax would boost local government budgets. The Guardian, 22 Feb.

[115] Mirrlees Review, 2011. Reforming the tax system for the 21st century. Institute for Fiscal Studies.

[116] A.Corlett, A. Dixon, D. Humphrey, and von M. Thun, 2018. Replacing business rates: taxing land, not investment.

[117] T. Aubrey, 2016. Bridging the infrastructure gap, Centre for Progressive Capitalism.

[118] D. Adler, 2017. Home Truths: A Progressive Vision of Housing Policy in the 21st Century. Tony Blair Institute for Global Change.

[119] C. Roberts, G. Blakeley, and L. Murphy, 2018. A Wealth of Difference: reforming the taxation of wealth. IPPR, Discussion paper.

[120] If taxes are based on sales values, and sales values have reflected speculative hopes of gaining planning permission, then people will be taxed almost as much as if their land has had development permitted. In that case it would be arguably be unjustified for local authorities to undertake Compulsory Purchase at existing use value, as we propose in Chapter 5.

[121] Having said this, supplementary taxes may be required to ensure that some highly successful businesses situated in low land value areas (such as Amazon’s distribution centres) are not given an unfair advantage relative to high street businesses. One way Labour are thinking about addressing this is through an online transaction tax; another option might be a monopoly tax.

[122] For example, there could be a sealed bid auction of C5 permissions, with the proceeds ring-fenced for building new social housing.

[123] The IPPR Commission on Economic Justice also recommended that the government investigate whether the Bank of England’s Financial Policy Committee should be given an explicit house price inflation target.

[124] G. Turner et al., 2018. Financing Investment: Final Report. GFC Economics Ltd & Clearpoint Advisors Limited, June 20, 13.

[125] Bank of England, 2009. The role of macroprudential policy: A Discussion Paper, London: Bank of England.

[126] G. Turner et al., 2018. Financing Investment: Final Report, GFC Economics Ltd & Clearpoint Advisors Limited, June 20, 14.